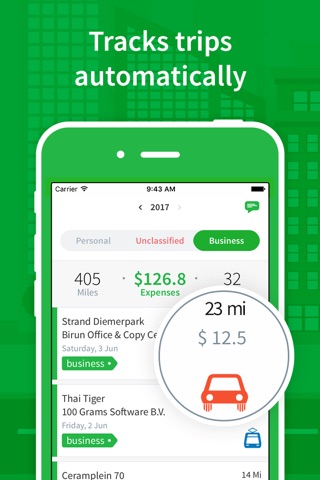

Mileage Tracker by Psngr app for iPhone and iPad

Developer: 100 Grams Software B.V.

First release : 22 Jun 2014

App size: 54.79 Mb

Simplify mileage logging for expense reimbursement and tax-deduction. Psngr tracks your trips automatically, calculates mileage and expenses, and generates reports for IRS tax deduction. You can track any number of vehicles and up to 40 free trips per month.

TRACK

• Start a new trip manually, and Psngr will record the trip until finish.

• Enable AutoPilot to let Psngr record all your trips automatically.

• Psngr auto-detects driving, cycling, walking and even trips made by public transit.

• Psngr automatically adds a stop to the trip when you stop, and resumes the trip when you start driving again.

• Psngr remembers locations and places you visited in the past, and reuses those in future trips.

• Forgot to log a trip? no problem! You can log any trip completed in the past by simply entering your past departure time.

CLASSIFY

• Swipe a trip to the right to classify it as #business. Expenses are calculated immediately based on mileage rates.

• Swipe a trip to the left to classify it as #personal or to delete it.

• Add any #hashtag to a trip for additional categorization or grouping or trips. You can later search trips by hashtag!

• Gain fine-grained classification control by splitting mixed business & private trips, or by merging consecutive trips in the same day.

REPORTS

• Psngr generates reports automatically - weekly, monthly, quarterly or annually.

• Reports can be configured to filter trips by vehicle, hashtag or driver.

• Reports include mileage, locations, vehicle info, expenses, CO2 emissions and more.

• Psngr Enterprise accounts allow employees to submit reports directly from the app, for review and approval by their manager.

VEHICLES

• You can track multiple vehicles with Psngr. Plug Psngr Beacon in each vehicle and the app will detect your vehicle automatically and log the trip accordingly.

• Create additional vehicles in the app to separate mileage logged with your private car vs. your company car, for different fiscal entities, different clients, projects, etc.

MILEAGE RATES

• Psngr bundles standard, tax-deductible mileage rates in 15+ countries, including US (IRS), UK (HMRC), Canada (CRA), Australia (ATO), New-Zealand, France, Germany, Switzerland, Belgium, Netherlands, Denmark, Austria, South-Africa, and Ireland.

• You can add custom reimbursement rates that suit your needs.

• Mileage rates provide rules for expensing trips based on daily, monthly or annual distance threshold. You can, for instance, set one rate for the first 10000 miles logged in a fiscal year, and another rate for each mile over 10000.

• You can create shared mileage rates for a team of drivers or employees.

PSNGR BEACON

• Psngr Beacon is a BLE (Bluetooth Low Energy) iBeacon USB device that you plug in your vehicle.

• The beacon increases tracking accuracy, enables vehicle detection, and allows you to share a vehicle with other drivers, thus maintaining a single vehicle logbook of all trips made, regardless of the driver.

• Using Psngr Beacon, you can restrict Psngr app to only track you when you drive a specific vehicle.

PUBLIC TRANSIT

When tracking trips by public transport, pre-plan your first trip in order to teach Psngr which transit lines you use to get from A to B.

PRICING

• The app is free to use forever. The free version is limited to 40 trips per month.

• For self-employed or single drivers, we offer Psngr Pro for unlimited tracking, as a monthly or annual subscription.

• For teams of multiple drivers or employees, we offer Psngr Enterprise as a monthly subscription via our website.

• Please see our Privacy Policy (https://psngr.co/privacy) and Terms of Use (https://psngr.co/terms) for further information.

Battery Use Disclaimer:

Psngr app uses GPS to track your location in the background. We have made extensive tests with all iOS devices to ensure minimal battery drain while Psngr is running. However, keep in mind that continued use of GPS can dramatically decrease battery life.

Latest reviews of Mileage Tracker by Psngr app for iPhone and iPad

This app gives you more than all the other apps and I love their reporting system. Its so easy to use and direct.

Nice and cool!! Really well done

Thanks! Ive been wanting this :-)

Ive got an account but cant use it or work out what the app actually does. Whenever I try to enter the details in it says account exists (duh).

I love this app. It tracks where I go on transit and I can earn badges. I can look through my past trips and see how far Ive gone and how. Its really fun.